CAN recommends a revenue neutral programme of increasing petrol excise tax, introducing diesel excise tax, reducing both company and income taxes to encourage more sustainable travel for people and goods.

Background:

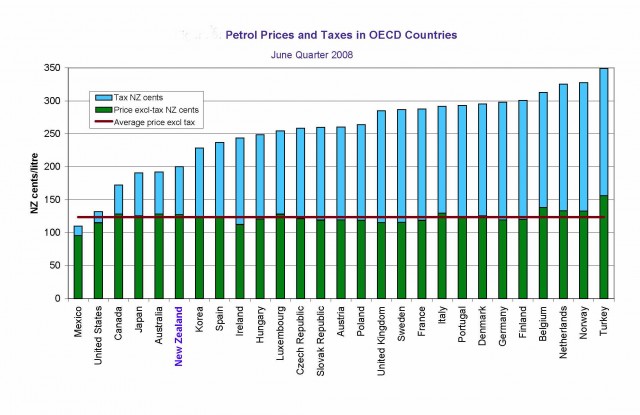

New Zealand has the 6th cheapest fuel of the 30 OECD (Organisation for Economic Co-operation and Development) countries (see Figure 1). New Zealand has one of the highest rates of car ownership in the world (NZTS, 2002), with the number of registered private motor vehicles having increased by 12 percent from 2003 to 2.3 million vehicles in 2008 (NZTA, 2009).

Figure 1: Petrol Prices and Taxes in OECD Countries (MED, 2009a)

According to EECA (2009), the transport sector consumes more energy than any other sector, representing 44% of NZ's total energy use. Transport is the fastest growing sector in terms of energy use, with its growth often outstripping the growth rate of the Gross Domestic Product (GDP). Since 1990, emissions from the transport sector have been growing at a rate of 3.1% each year with some reduction in the rate of growth corresponding to higher fuel prices between 2005 and 2006 (EECA, 2007).

A report by the OECD (2000) concludes that "The rate of increase in transport's impacts is much beyond what the planet can tolerate; it is therefore unsustainable."

By raising prices on less sustainable products and practices, taxes and charges can be effective in influencing consumer behaviour towards sustainability. This will influence consumers only if the financial stimulus is strong enough to enter the decision-making process. Taxes and charges may be more effective as part of a wider tax reform strategy. For example, countries such as Austria, Finland, Germany and Sweden have tax-shifting programmes to introduce more environmental taxes in place of those on capital and labour. In cases of disadvantaged groups of consumers, taxes can be graduated according to consumption levels, combined with compensation for poorer households or accompanied by offsets in different areas of taxation (OECD, 2008).

CAN recommends that the NZ Government should embark on such a tax-shifting programme, by increasing the excise tax on petrol, introducing a new levy on diesel and reducing income and company tax rates as a compensation to individuals and industry. Such measures would make the use of transport fuel more expensive with a compensating reduction in the tax burden on individuals and companies. Those tax changes could be structured so that they are revenue-neutral for the Government but give individuals and industry incentives to travel less, reduce freight, use more efficient modes or more efficient vehicles. As such, this proposal would help implement the government's Energy Efficiency and Conservation Strategy, the 2002 NZ Transport Strategy and the targets and goals set out in the draft Updated NZ Transport Strategy (UNZTS, 2008).

Since July 2007, petrol has been subject to an excise tax of 42.524 cents/litre, with the income going to the Crown bank account and the National Land Transport Management Fund. Diesel is not subject to excise because road user charges are levied on diesel vehicles, with the revenue collected dedicated to the National and Regional Land Transport funds (MED, 2009b).

CAN's proposal is to add an additional 20 cents/litre excise going to the Crown bank account for both petrol and diesel in year one. As this is subject to GST, the pump price of fuel would thus increase by 22.5 cents/litre. In the following year, an additional 10 cents/litre of excise is proposed to be added.

At the same time, CAN proposes that Government lowers income and company tax rates as a compensation to individuals and industry so that the tax take is roughly maintained. It can be expected that such a measure would result in less fuel consumption and more use of sustainable transport modes including walking, cycling and public transport. As individuals and companies have an incentive to become more sustainable, those who make appropriate travel choices will be rewarded by monetary savings, as their tax burden is reduced, whilst those who maintain their current travel or transport habits pay more.

CAN believes that:

- Petrol and diesel excise should be increased by 20 cents/litre in year one and by an additional 10 cents/litre in year two.

- Simultaneously, Government should lower income and company tax rates so that the overall tax take is revenue neutral.

- This tax-shift would help achieve Government's targets of lower transport energy consumption and increased use of sustainable transport modes, including walking and cycling.

References:

All internet references have last been accessed on 28 August 2009.

- Energy Efficiency and Conservation Authority (EECA, 2007) New Zealand Energy Efficiency and Conservation Strategy: Making it happen. Wellington.

- Energy Efficiency and Conservation Authority (EECA, 2009) - available online at http://www.eeca.govt.nz/eeca-programmes-and-funding/programmes/transport

- Ministry of Economic Development (MED, 2009a) - available online at http://www.med.govt.nz/templates/Page____38625.aspx

- Ministry of Economic Development (MED, 2009b) - available online at http://www.med.govt.nz/templates/Page____12961.aspx

- New Zealand Transport Strategy (NZTS, 2002), Wellington.

- Organisation for Economic Co-operation and Development (OECD, 2000) Environmentally Sustainable Transport: Futures, Strategies and Best Practices. Vienna, Austria

- Organisation for Economic Co-operation and Development (OECD, 2008) Promoting Sustainable Consumption: Good Practices in OECD Countries. Paris, France.

- NZ Transport Agency (NZTA, 2009) - available online at http://www.landtransport.govt.nz/statistics/motor-vehicle-registration/

- Updated NZ Transport Strategy - draft (UNZTS, 2008), Wellington.

CAN's Vision:

Cycling is used as a means of transport by most people for some trips each month.

CAN's Objectives:

- 80% of people cycle for some trips each month by 2020

- 20% of all trips are by cycle by 2020

- 90% of those who cycle are satisfied with their cycling experience by 2020

- Rates of fatality and injury for cycling are below that for cars (currently 5 per 100 million km) by 2020

- Cycling is perceived as positive by 90% of the general population by 2020

| Attachment | Size |

|---|---|

| 46.11 KB | |

| 110.19 KB |

Comments

Is there an updated fuel tax

Is there an updated fuel tax policy this year? kansas city mole control

divorce lawyers columbus ohio

Those tax changes could be

Those tax changes could be structured so that they are revenue-neutral for the Government but give individuals and industry incentives to travel less, reduce freight, use more efficient modes or more efficient vehicles.

Drywall Contractor Dallas kansascitydrywallcontractor.com houstonautoglassguy.com crawl spaces encasulation

This is a very complex issue

This is a very complex issue, and there are many ways that the tax changes could be structured to achieve these objectives. However, it is important to note that this is a revenue-neutral proposal, which means that the government would not be increasing its revenue from these changes. www.drywallproscleveland.com

It is important to note that

It is important to note that taxes and charges may have a greater impact on disadvantaged groups of consumers who may not have the means to shift to more sustainable modes of transport. As such, the proposal also suggests graduating taxes according to consumption levels, combined with compensation for poorer households or accompanied by offsets in different areas of taxation to ensure that the transition towards sustainable transport is equitable. Best Fort Lauderdale storage companies

In addition to my previous

In addition to my previous comment,

When designing policies to promote sustainable transportation, it's important to consider the potential impact on disadvantaged groups. Taxes and charges can have a disproportionate effect on low-income individuals or households who may not have the financial means to switch to more sustainable modes of transport, such as electric vehicles or public transportation.

To address this issue, the proposal suggests implementing a graduated tax system that takes into account consumption levels. This means that the tax rate would increase as the amount of consumption or usage of non-sustainable modes of transport increases. This can help to incentivize people to choose more sustainable options and reduce their carbon footprint.

However, it's also important to ensure that the transition towards sustainable transport is equitable. This can be achieved through compensation for poorer households or offsets in different areas of taxation. For example, revenue generated from sustainable transport taxes could be used to fund subsidies for public transportation or electric vehicles, which would benefit low-income households. Alternatively, revenue could be used to offset other taxes, such as income tax, to ensure that the burden of sustainable transport taxes is not disproportionately borne by low-income individuals.

Overall, a comprehensive approach that takes into account the needs and circumstances of different groups of consumers is necessary to ensure that the transition towards sustainable transport is both effective and equitable. SEO Cincinnati

We don’t yet know all the

We don’t yet know all the details of the new Government’s plans for this issue. Midland

Those tax changes could be

Those tax changes could be structured so that they are revenue-neutral for the Government but give individuals and industry incentives to travel less, reduce freight, use more efficient modes or more efficient vehicles. https://www.mediafoundationrepair.com/https://adamstreeservicetx.com/service-areas/

Such measures would make the

Such measures would make the use of transport fuel more expensive with a compensating reduction in the tax burden on individuals and companies. cambridge house cleaning services car accident lawyer https://concretedrivewayperth.com.au/ click here

I think it's a good idea to

I think it's a good idea to increase the tax on petrol and diesel, but I'm not sure about the proposed excise tax on diesel

https://www.drywallwinstonsalem